More than 154 million Americans can expect to receive tax refunds this year, with the average amount clocking in at $3,068. A chunk of money like that is an opportunity to do something important, especially for parents looking out for their children’s futures. Here are five ways parents can spend their tax refunds wisely.

1. Fund a 529 plan for college —OR before.

As you probably know, 529 plans were originally created to help pay for college. The big benefit of them is that they grow tax-free, as long as you use the money for qualified college expenses, from tuition to text books. So that’s reason enough to consider using your tax refund to fund or fatten a 529.

But here’s another reason: If you send your children to private school, you can now use money saved in a 529 plan to pay their kindergarten through 12th grade tuition. This is brand new starting with the 2018 tax year, the one people are filing now. You can use up to $10,000 per student from a 529 to pay for private school. If you want to pursue this, just be sure to check with the states where you live and have your 529, because most but not all states have changed their 529 rules to align with the new federal law.

2. Invest in straightening your teen’s teeth.

This is something you want to take care of before your teens go off to college —for health AND self esteem reasons, so why not earmark your tax refund for this purpose? If your teen has been resisting the idea, keep in mind that millions of teens have now undergone successful Invisalign treatment instead.

My daughter Kelsea is one of them. MY favorite part about the Invisalign treatment is how quickly and easily her teeth are moving. These things are proven to WORK on teen teeth! HER favorite part is that she feels like herself wearing the Invisalign aligners. What we both appreciate is that, thanks to Invisalign treatment, we haven’t had to miss basketball or play practice to get broken wires fixed. And since the Invisalign aligners are removable, Kelsea doesn’t get “hangry” missing her favorite foods —like popcorn.

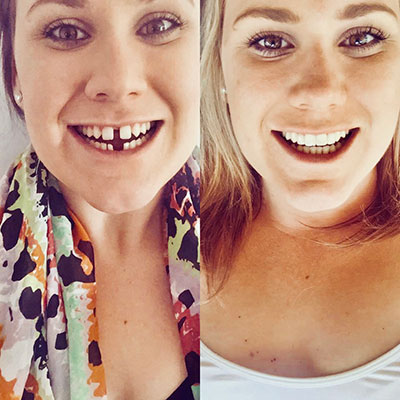

Kelsea’s case is pretty straight forward, but Invisalign treatment is also proven to work on more complex cases. Before and after photos really tell the story of what these small but mighty pieces of plastic can accomplish.

photo credit: @JemmaDargusch

What a difference! So, parents, if you’re curious, there’s a cool tool at Invisalign.com that shows you all of the Invisalign-trained orthodontists in your area who can tell you if your teen is a candidate.

3. Send your kids to camp.

In a 2014 study, parents who sent their kids to camp reported significant positive changes in their children’s social skills, such as the ability to choose good people to befriend and then the ability to talk to those friends about things that are important to them. And when the kids themselves were surveyed, the vast majority of them reported feeling happier and more content after attending camp.

Plus, these days, there are so many fascinating camps where children and teens can learn important skills. My own daughter has been to filmmaking camp, sewing camp and this summer she’s trying woodworking camp. A neighbor boy spends most of his summer in coding camp. Not to mention all of the classic skills kids can learn at traditional camps, from canoeing to building a camp fire.

Sleepaway camp costs an average of about $800 a week, so a typical tax refund of about $3,000 will pay to send siblings or for several weeks for one child. Plus tax refunds conveniently arrive right around now when camp deposits are due.

4. Donate to charity as a family.

We all want to teach our kids to give back and one way to jump start that process is to give them money to give away. You could utilize all or part of your tax refund for that purpose. The idea is to engage your children in thinking about what causes are important to them. You can then research worthy groups as a family. Each child can select a charity to donate to if you feel having their own individual choice will be the best learning experience. Or you can pool your money so that the entire family gets the benefit of coming to a consensus and so that a single recipient receives a chunkier donation for a greater impact.

Your children will benefit just as much as the group that receives your donation. On a basic level, they’ll get to practice their research, math and money skills. On a more abstract level, they’ll learn empathy and that there are all kinds of different people in the world. If you want to really put an exclamation point on this family project, see if there is a way to incorporate a field trip into your giving. Can you go serve meals to the homeless as a family? Read to children in a literacy program? Walk dogs at an over-crowded animal shelter? Get creative and you’ll get back more than you give away.

5. Use your tax refund —and tax credits— to adopt a child.

Finally, here is an idea for people who are not parents, but who would like to be. Why not use your tax refund as the seed money to adopt a child? There are more than a hundred thousand foster children right here in the United States who are eligible for adoption and if you include international children who need homes, the number grows dramatically.

And here’s the thing people may not know: in addition to putting your tax refund toward adoption, the United States offers an adoption tax credit. So, for 2018, for example, adoptive parents can receive a credit of nearly $14,000 dollars for each child they take in. This money is meant to cover the expenses parents incur to complete an adoption. And remember, it’s a credit —not a deduction— which means it’s a straight reduction in the amount of tax you owe.

If you do add a child to your family, there’s something new starting this 2018 tax year: Parents get a child tax credit of $2000 for each child, which is double the old credit. Plus there are a slew of other possible tax credits for parents. Bottom line: adopt for love, but don’t miss out on the tax incentives you’re entitled to.